Net Investment Income Tax NIIT. Additional Director means a person appointed to be an Additional.

Explore Our Sample Of Condominium Association Budget Template For Free Profit And Loss Statement Weekly Budget Template Budget Template

20 lakhs Schedule AMTC.

. 4D of section 10. For rental income received in 2021 Under the Rental Relief Framework owners ie. Landlords of qualifying non-residential properties would also have received a cash grant in 2020 and are required to.

The gross rental income from the property is less than 2 of the smaller of the unadjusted basis or. The tax year or during at least 2 of the 5 preceding tax years and. Computation of Alternate Minimum Tax payable under section 115JC.

The following table sets forth the computation of net income loss per share on a basic and diluted basis for the periods indicated share count and dollar amounts other than per-share amounts. 21AJDetermination of income of a specified fund attributable to units held by nonresidents under subsection 1A of section 115AD. NIIT is a 38 tax on the lesser of net investment income or the excess of modified adjusted gross income MAGI over the threshold amount.

Adjustment as per section 115JC2 Adjusted Total Income under section 115JC1 12a Tax payable under section 115JC 185 of 3 if 3 is greater than Rs. This is an auto-populated figure taken as aggregate of head-wise income column 123c4d 6. 25000 for self and dependent family members.

Computation of tax credit under section. We would like to show you a description here but the site wont allow us. You may be subject to the NIIT.

Computation of tonnage income. Net investment income may include rental income and other income from passive activities. Manner of computation of income under tonnage tax scheme.

Landlords of qualifying non-residential properties can refer to the Tax Treatment of Rental Relief Measures under the Rental Waiver Framework for Year of Assessment 2022. Schedule AMTC- Computation of tax credit under section 115JD. The activitys average period of customer use equals the sum of these class-by-class average periods weighted by gross income.

This amount includes a maximum of Rs. Form 3624 must be accompanied by evidence that the applicant meets the standards of a qualifying category in 12 and that the organization is nonprofit eg a certificate of exemption from federal income tax. See Regulations section 1469-1e3iii.

However a maximum of Rs. Losses of current year to be set off against 5. An exemption from the payment of federal income tax is not required to qualify for the Nonprofit USPS Marketing Mail prices.

35000 can be claimed as a income tax deduction under Section 80D. Total Income as per item 12 of PART-B-TI. Rental income from machinery plants buildings etc Gross.

Use Form 8960 to figure this tax. Under this income tax section you can claim deductions equal to the amount spent for medical expenses for self or dependent family members.

Mortgage Calculator Monthly Payments Screen Mortgage Loan Originator F Mortgage Loan Calculator Mortgage Payment Calculator Mortgage Amortization Calculator

Pin On Perfect Realestate Investments

Renters This Chart Is Eye Opening Contact Me So We Can Discuss How To Get You On Your Way To Home Ownership And St Home Ownership Start Investing Investing

Thoughts On Virtual Crypto Currency Taxation In The Us Advanced American Tax

Adviser Keith Whitcomb Talks About How To Calculate When You Should Claim Your Social Security Social Security Benefits Retirement Benefits Retirement Planning

Expense And Profit Spreadsheet Profit And Loss Statement Statement Template Cash Flow Statement

Is Property Investment More Profitable Than Stock Investment Investment Property Investing Real Estate Investing

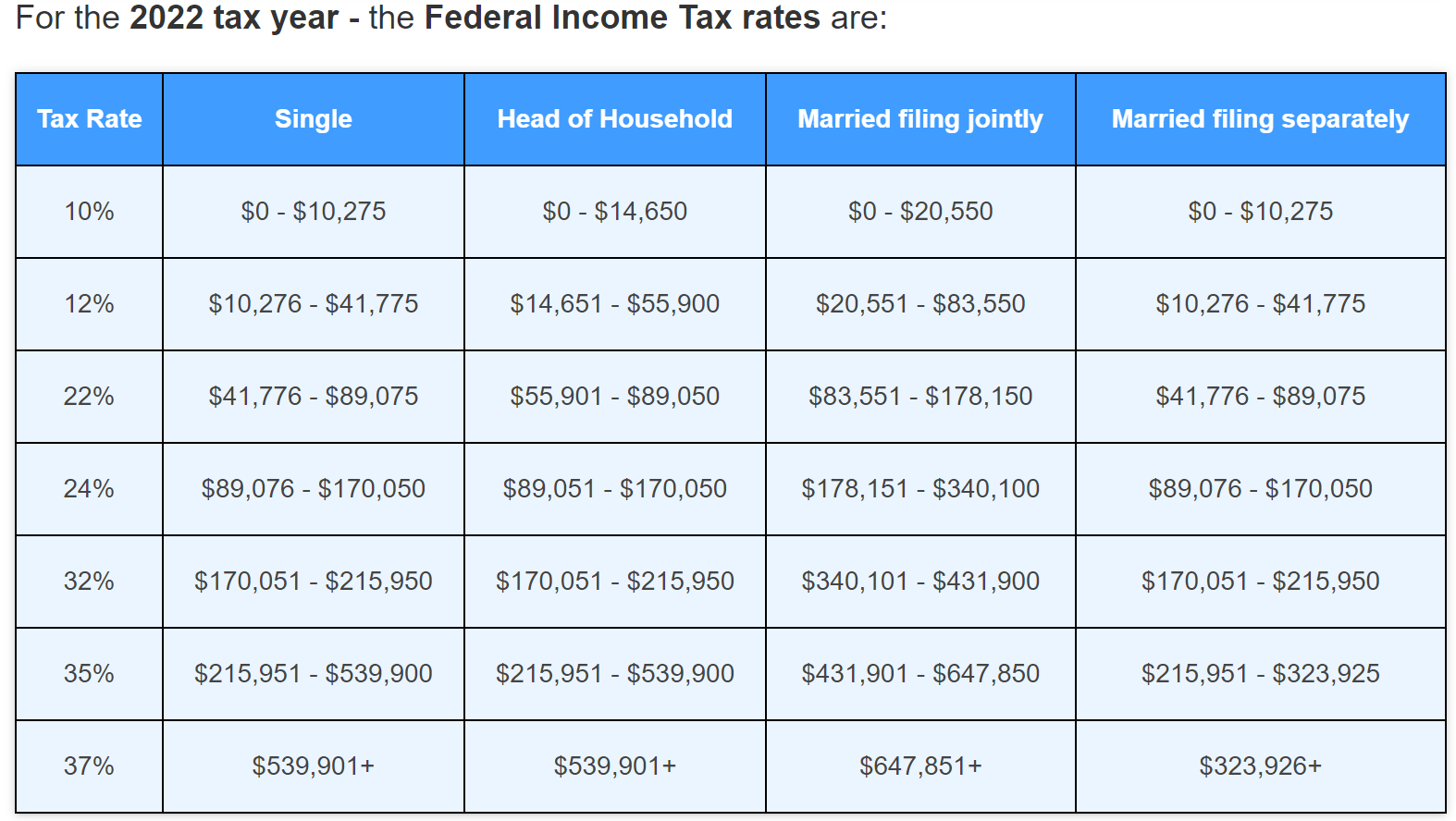

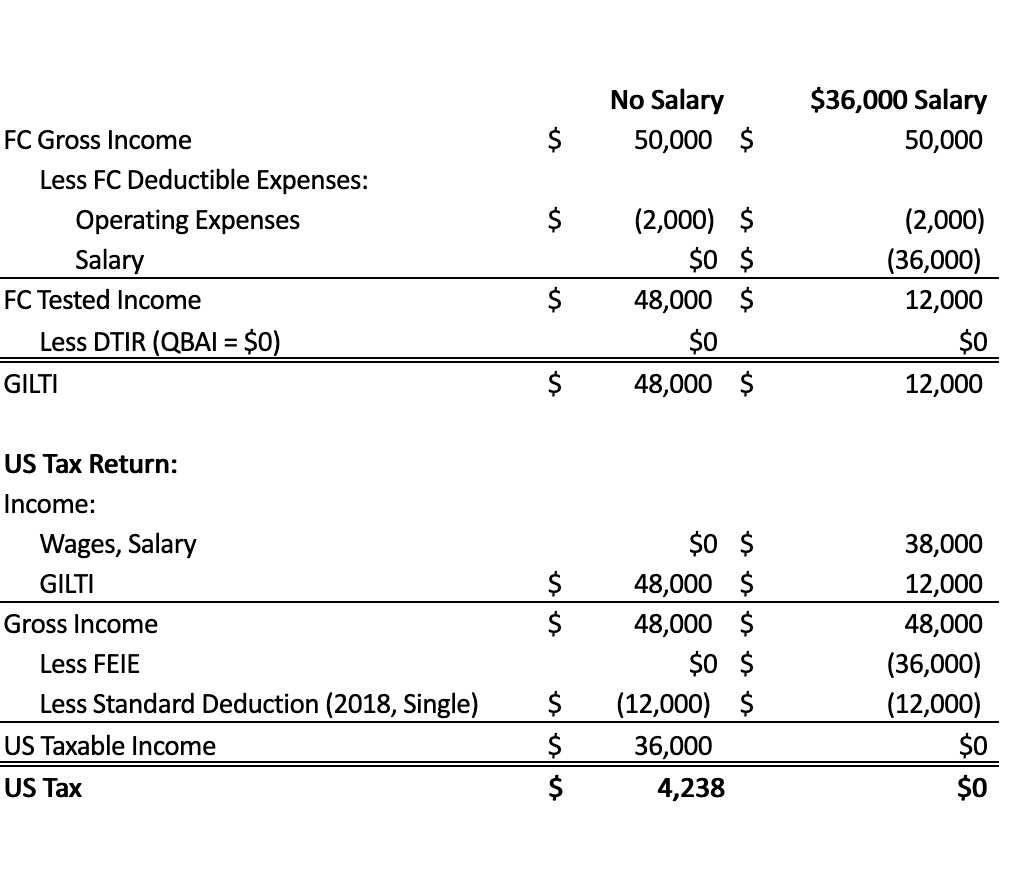

Getting To Know Gilti A Guide For American Expat Entrepreneurs

Why Is A Mortgage Calculated Based On Gross Income In 2022 Mortgage Mortgage Loans Income

Pin By John On Borderlands 3 Borderlands Borderlands 3 Borderlands Art

24 Examples Of Calculated Metrics In Google Analytics Google Analytics Marketing Approach Analytics

Airbnb Rental Income Expense Spreadsheet Rental Income And Etsy Spreadsheet Design Rental Income Spreadsheet

Download Turbotax Desktop Tax Preparation Software And Do Your Taxes On Your Computer Choose From Basic Personal Taxes Tax Software Tax Refund Tax Preparation

Wacc Calculation Finance Investing Finance Lessons Financial Management

New Construction Property Offers Better Returns That Resale Property Boost Economy New Construction Real Estate Marketing

Why Hra Generator Is Important Income Tax Income Tax Return Tax Refund